Posts filed under ‘Help to Buy’

UPDATED: Mortgage approvals drop to lowest level in a year

The number of mortgages approved for people buying a property fell for the second month running in August, figures showed today.

A total of 10,357 loans were in the pipeline for house purchase during the month, down from 10,703 in July, according to the Bank of England.

It was the lowest monthly figure since September last year, with the exception of April and May, when the market was disrupted by the introduction of tough new lending criteria under the Mortgage Market Review.

The data adds to growing evidence that the booming property market is beginning to cool, as buyers become more cautious in the face of recent strong house price gains and the prospect of future interest rate rises.

Bank of England Governor Mark Carney warned last week that the point at which interest rates would start to rise from their current record low of 0.5 per cent was “getting closer”.

Bank of England Governor Mark Carney warned last week that the point at which interest rates would start to rise from their current record low of 0.5 per cent was “getting closer”.

Total mortgage advances increased slightly during the month, rising to 17.46 billion, up from 17.2 billion in July.

The figures came as the National Association of Estate Agents warned that the younger generation continued to be squeezed out of the property market.

The group said the number buyers aged between 18 and 30 remained at an all-time low of just 3 per cent of sales in August.

There was some good news, with the proportion of sales accounted for by people buying their first home rising to 28 per cent during the month, the first increase since April and up from just 20 per cent in July.

But the majority of people getting onto the property ladder are thought to be aged aged between 31 and 40, with this age group accounting for 45 per cent of all sales, the highest proportion ever recorded for August.

Mark Hayward, managing director of the National Association of Estate Agents, said: “Reports from our NAEA members suggest that the high house prices of the current housing market are still proving a barrier for the younger generation.

Mark Hayward, managing director of the National Association of Estate Agents, said: “Reports from our NAEA members suggest that the high house prices of the current housing market are still proving a barrier for the younger generation.

“It is evident that first-time buyers are indeed getting older, with the majority of home buyers this month aged 31 to 40, suggesting some correlation between the increase in the first-time buyer market and this age group.”

The number of properties for sale fell slightly during August, dropping to an average of 49 per estate agent branch, down from 51 in July.

There was also a dip in the number of sales agreed, with transactions falling to an average of eight per branch in August, compared with nine the previous month.

But there was an increase in the number of people looking to buy a home, bucking the recent trend, with 372 house hunters registering with estate agents, up from 368.

But nearly 90 per cent of estate agents think the expected increase in interest rates will affect demand for property, with 39 per cent of agents saying they have already seen a cooling.

Meanwhile, the Government has announced plans to extend the Help to Buy scheme to enable more young people to get on to the property ladder.

It said first-time buyers aged under 40 would be offered discounts of 20 per cent on 100,000 new build homes.

The discount will be made possible by releasing brownfield sites to builders and exempting them from certain taxes.

Help to Buy scheme needs a ‘permanent replacement’

The Government should introduce a permanent replacement to its Help to Buy scheme to enable more people to get on to the property ladder, a report claimed today.

Mortgage insurer Genworth estimates that up to two million people who would like to have bought their first home since 2007 may not have been able to do so.

The group blamed the situation on the introduction of tougher mortgage regulations and greater capital requirements for lenders.

It said since new regulations were introduced in 2008 and 2009, there had been a dramatic reduction in high loan-to-value mortgages, while those that remained had become more expensive.

But it said the situation could be improved by introducing a mortgage insurance scheme to help lenders spread the risk of high loan-to-value loans.

The group found that someone buying a home costing £147,000 with a 75 per cent loan-to-value two year fixed rate mortgage would pay £496 a month, but someone buying the same property with a 95 per cent loan-to-value loan would face repayments of £843.

But it said a system of mortgage insurance for high loan-to-value loans could help to keep mortgages for people with small deposits affordable by transferring some of the risk away from lenders, while it would also protect the safety of the financial system.

Simon Crone, vice president for mortgage insurance (Europe) at Genworth, said: “The scale of frustrated demand is growing larger by the day.

Simon Crone, vice president for mortgage insurance (Europe) at Genworth, said: “The scale of frustrated demand is growing larger by the day.

“Help to Buy must become a precursor to a permanent system where mortgage insurance for high loan-to-value loans – backed by capital relief – plays an ongoing role in helping first time buyers access the market, ensuring a sustainable rise in house building and protecting the safety of lenders and the financial system.”

The group used government and industry data to compare the number of people entering the housing market with expected demand.

It found that the number of people buying their first home was consistent at 10.26 million a year between 1985 and 2006, only slightly below the figure of 10.29 million, which would be expected based on population trends.

But it said since 2007 there had been a large and persistent deficit in first-time buyer numbers.

It estimates between 2007 and 2013 1.8 million people who would have hoped to buy their first home have been unable to do so.

It added that although the Government’s Help to Buy scheme had helped, nearly half of people who were expected to want to buy a home during 2014 were still unlikely to be able to do so.

Based on figures for the first six months of 2014, Genworth estimates there will be 296,200 first time buyers during the year as a whole, despite demographic trends suggesting more than 500,000 people would like to get on to the property ladder in 2014.

Housing minister insists affordable homes are available in London

Hardworking families in London are being provided with ‘tens of thousands’ of new homes, the Government’s housing minster has exclusively told Zoopla.

Brandon Lewis, who was appointed to the Government post earlier this year, insisted affordable homes are being provided for those wanting to live and work in the capital.

His comments come in the same week that the Government’s flagship Help to Buy scheme was deemed ‘a flop’ by the opposition – particularly for those hoping to buy in London.

Housing Minister Brandon Lewis said: “Everyone has the right to live in a safe and affordable home. This Government has worked tirelessly to make that possible and fix the broken housing market we inherited from the last Government.

Housing Minister Brandon Lewis said: “Everyone has the right to live in a safe and affordable home. This Government has worked tirelessly to make that possible and fix the broken housing market we inherited from the last Government.

“Our current affordable homes programmes is on track to deliver 170,000 new homes by 2015, to be followed by a further 165,000 by 2018, which will be the fastest rate of affordable house building for 20 years.

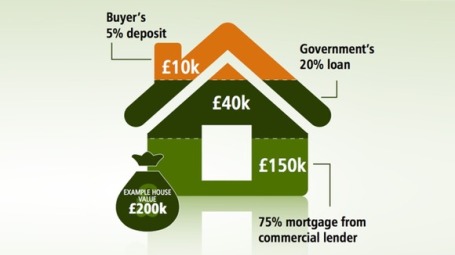

He claimed the Government’s Help to Buy scheme, which helps those with a small deposit to buy a home, was a key element in helping people onto the property ladder.

“Our Help to Buy scheme has enabled over 40,000 aspiring households to buy their first home with a fraction of the deposit they would normally require, and our action to cut the deficit has kept interest rates low and mortgages more affordable,” he said.

“And in London Help to Buy equity loans have allowed over 1,400 people to get a foot on the housing ladder. We have also increased discounts for council tenants looking to exercise their Right to Buy and have introduced new housing zones to boost house building and create tens of thousands of new homes for hardworking families across the capital.

However, he admitted that more need to be done to improve the property market. As well as struggling to save for a deposit, many home buyers are unable to keep up with the sharp rise in house prices, particularly in London.

The typical value of a home in Britain has increased almost £18,000 in the past year to £275,721, while in London they have risen by more than £60,000, according to Zoopla.

Lewis said: “The sector is clearly moving in the right direction, but there is still more to do, and improving the housing market will continue to be a vital part of our long-term economic plan,” he said.

Number of first time buyers recovers to pre-credit crisis levels

The number of people taking their first step on to the property ladder hit a seven-year high in July, research showed today.

A total of 30,000 first time buyers bought a home during the month, the highest level since August 2007 and 25 per cent more than in July 2013, according to LSL Property Services.

There was also a 10 per cent drop in the amount first time buyers put down, with deposits falling to £26,642, £3,000 less than a year earlier.

The Government’s Help to Buy scheme continued to have an impact on the proportion of a property’s value that lenders were prepared to advance, with average loan to value ratios rising to 82.9 per cent, compared with 79.5 per cent in July 2013.

But it was not all good news for people taking their first step on to the property ladder, with the typical mortgage rate they secured rising for the fourth consecutive month, increasing to 4.19 per cent, up from 3.99 per cent in March.

This higher rate also led to the size of mortgage repayments as a proportion of income growing to 22.6 per cent, compared with 20.2 per cent a year ago.

People typically spent £155,844 on their first home, 8 per cent more than the average amount paid a year earlier.

Despite the drop in the average deposit put down by first time buyers, people still needed to save the equivalent of 72 per cent of their annual pay towards their first home.

But this figure was down from 82.6 per cent of earnings in July 2013, also reflecting the fact that the average salary of people buying their first home had risen to £37,000 from £35,843 a year earlier.

David Newnes, director of estate agents Your Move and Reeds Rains, part of LSL Property Services, said: “The first-time buyer market is still active, even as the wider property market is starting to show signs of cooling down.

David Newnes, director of estate agents Your Move and Reeds Rains, part of LSL Property Services, said: “The first-time buyer market is still active, even as the wider property market is starting to show signs of cooling down.

“As the economic recovery gathers momentum, more buyers are finding themselves in a position where they can afford to own their own home.”

He said a whole generation of first-time buyers had found themselves stuck on the side-lines of the property market as the economy recovered from the recession and real wages fell.

But he added: “The recent increase in high loan-to-value lending options – enabled by Help to Buy – has allowed them a shot at getting on the ladder at long last, and the number of first time buyers has climbed to a seven year high.”

Strong house price growth seen in recent months has pushed the average price paid for a first home above the £150,000 barrier in London, the South East, East, South West and Wales.

Unsurprisingly, London was the most expensive place in which to buy a first property at an average of £251,061, followed by the South East at £194,955.

At the other end of the spectrum, Northern Ireland and Yorkshire and Humber had the cheapest properties at an average of £89,470 and £103,741 respectively.

First time buyers in London typically saved £62,253 for a deposit, nearly six times more than the £10,710 put down by people getting on to the property ladder in the North East.

Number of properties changing hands begins to ‘cool’, reveals Gov’t figures

Property transactions slumped in July as the housing market continued to show signs of cooling, Government figures revealed today.

A total of 101,190 homes valued at more than £40,000 changed hands during the month on a seasonally adjusted basis, 1.3 per cent fewer than in June and the lowest level since December 2013.

But despite the dip, sales levels were still 13.5 per cent higher than they had been in July 2013, according to HM Revenue and Customs.

The figures add to growing evidence that the property market is beginning to slow down, as buyers balk at the high prices being demanded by sellers.

The introduction of the Mortgage Market Review is also thought to have contributed to the fall in sales, as the new rules, which include stricter affordability criteria, have lengthened the mortgage application process.

House price gains also appear to be moderating, with Nationwide Building Society reporting that property values remained largely unchanged in July, rising by just 0.1 per cent.

In its latest Agents’ Summary of Business Conditions, which was released yesterday, the Bank of England also said housing transactions had eased in recent months.

It added that house price growth was slowing in the South, with some areas seeing price falls, while there were fewer cases of sealed bids and people making offers over the asking price, as some of the heat came out of the market.

Strong house price gains have left the typical British property costing £263,705, according to Zoopla.

But despite evidence that the housing market is slowing in the South, there are also suggestions that price growth is accelerating in other areas, as the recovery ripples out across the country.

Meanwhile, separate figures released today showed that the number of new homes started by builders rose by just 0.3 per cent during the second quarter of the year, well down on the 10.7 per cent jump recorded during the previous quarter.

But the total of 36,200 new homes started during the three months was still nearly 24 per cent higher than during the same period of 2013, according to the department of Communities and Local Government.

But the total of 36,200 new homes started during the three months was still nearly 24 per cent higher than during the same period of 2013, according to the department of Communities and Local Government.

The increase was driven by a rise in private housing starts, which were up 1.6 per cent at 29,900.

New properties started by housing associations and local authorities fell by 5.6 per cent.

Paul Diggle, property economist at Capital Economics, said: “The marginal gain in housing starts in the second quarter suggests that material and labour shortages are constraining housebuilders’ output.

“Despite the impetus from the Help to Buy equity loan scheme and favourable wider economic conditions, these constraints will keep a lid on housebuilding for a while yet.”